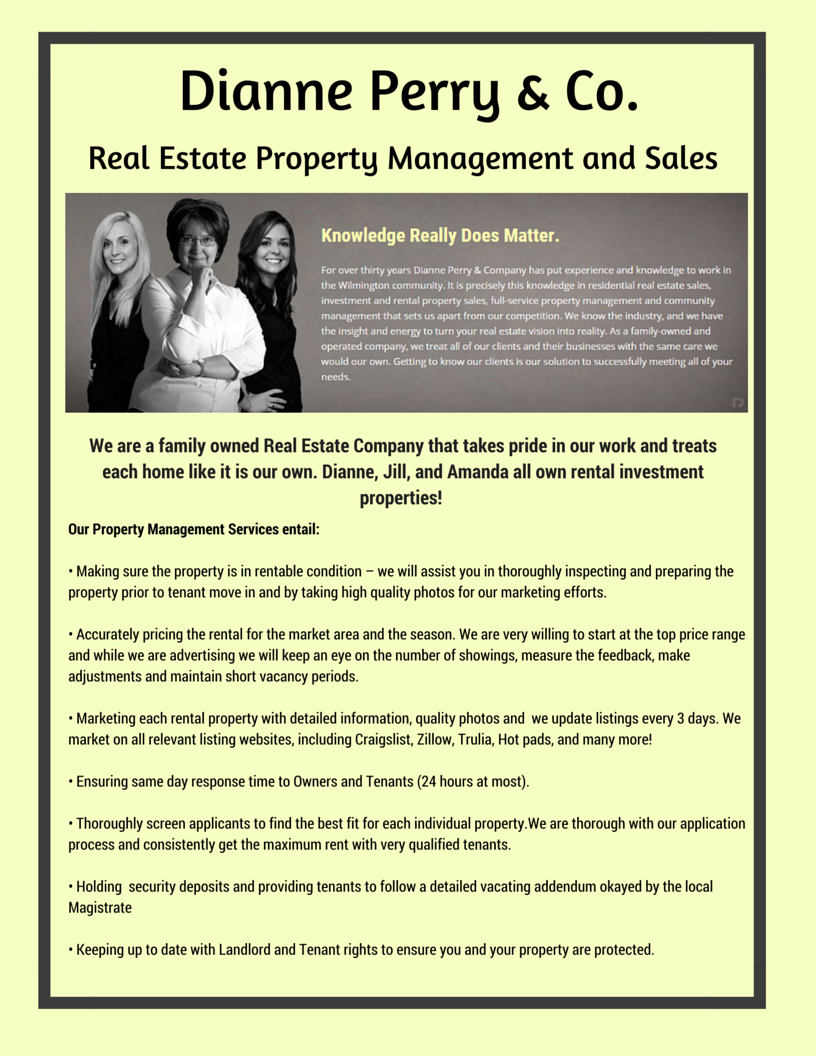

Looking for Property Management in Wilmington NC? See the difference that Dianne Perry & Company offers!

So you’ve decided to buy your dream home. Congratulations! You’ve been pre-approved, know your budget, and have a list of what you’re looking for. Here are three other tips to help you make the right investment:

1. Do Your Research on The Neighborhood

It is easy to be swayed by a beautiful house with all the right features, but don’t forget to investigate the neighborhood. Are you close enough to everything you need, like grocery stores and pharmacies? Or if you want peace and quiet, are you far enough away from noisy streets? Consider what kind of neighborhood you would like to be in before you begin your search so that you can be sure you love where you live

2. Know the Age of the Property

You’ve found the cutest house of your dreams, straight out of an old Hollywood movie. But, does it need some TLC? Will certain aspects of the house need to be brought up to date? Be aware of the age of a property and any necessary work that may need to be completed. It is also important to consider if modern upgrades will truly be feasible in the home. Determine how much work you are willing to do and what you want to have move in ready.

3. Consider Size & Space

Be realistic about how much space you want and need. Having enough space is crucial, but having too much space can be overwhelming. If you know that you will have visitors frequently, be sure that the property has enough space so that you don’t feel crowded. If you are trying to downgrade, make sure that you can easily manage maintenance and cleaning of the property. If there is too much space, the upkeep may become difficult or costly. Be realistic about what kind of space you want -inside and outside- and you will be perfectly content in your new home.

Have any tips we missed? Sound off in the comments!

1. Know Your Numbers!

One of the best ways to improve your credit is to be aware of your credit score! Several websites, apps, and even certain credit card companies will provide free credit information. Here are some of our favorite resources for checking credit scores:

2. Pay Your Bills on Time.

Paying on time is one of the most important factors of good credit. Late payments and collections often have a negative impact on your credit score. A great way to stay on top of your payment due dates is by setting up calendar alerts ahead of time! It may also be helpful to get emailed statements and bill reminders from your credit card company.

3. Don’t Let Your Balance Get Too High.

High outstanding debt can obstruct a good credit score. Usually a credit card balance over 35% of your limit can begin to hurt your credit score. Be mindful if you’ve racked up some high charges and work to pay off high debt as quickly as possible. It’s also important to pay off your debt rather than move it around. If you have a large balance, make a game plan for paying it off.

4. Avoid Applying for and Opening Too Many Accounts.

Applying for or opening too many accounts may negatively impact your credit score. If you have been managing credit for only a short amount of time, don’t rush to open more credit accounts. Only apply for the credit you need and don’t take on more than you can handle. If you’re unsure about what to do, speak with a customer service representative or a financial advisor.

5. Don’t Stop Using Your Credit.

If you have a low credit score, you may be afraid of continuing to use your credit card. However, it is important to work to improve your credit score and show lenders that you are responsible. Just remember to be aware of your spending and to stay on top of your payments.

These statistics below compiled from our local MLS indicate steady improvement in all locations of our thriving Cape Fear area. If you are thinking of selling this year give us call so we can tailor a plan for your real estate. It is still a great year to purchase an investment property – which remains the best return on your investment dollar by most everyone’s standards. Contact us to learn more about investing in our local real estate. We have successfully helped many clients start and increase their portfolios.

By Sherri Pickard, GRI, SFR, CDPE

2015 President, Wilmington Regional Association of Realtors

WILMINGTON, N.C. (January 16, 2015) – When analyzing eleven major zip codes in our region – 28401, 28403, 28405, 28409, 28411, 28412, 28451, 28480, 28428, 28449, and 28443 – an average of the zip codes shows for the year-end of 2014:

• Our average sales price has increased by 4.6% from year-end 2013.

• Of the 5,000 sellers in 2014 – 34.0% paid some sort of concession toward the purchase of the house.

• Our list to sales price ratio for year-end is 96.20%, a decrease from 96.37% for year-end 2013.

• The average list price of the sold properties is $273,531 and is up 4.8% from year-end 2013.

• The average number of days a property remained on the market for the year was 119 days, compared to 121 days for year-end 2013.

• The median sold price of $217,250 for year-end has increased 8.6% from year-end 2013.

The areas of focus in this analysis were:

• Selling Price – The price the seller accepts for his or her house.

• Sellers Concessions – The amount of money a seller of a house contributes toward the buyers purchase.

• List to Sales Price Ratio – The difference between the list price and the selling price shown as a percentage.

• Days on Market – The number of days a house remains for sale, from the listing date to the date the property is placed under contract.

• List Price – The amount of money a home is listed on the market.

• Median Price – The middle price of all the properties sold in the given time period.

28401

• The average selling price of $132,649 has decreased 2.4% from year-end 2013 average selling price of $135,949.

• 27% of sellers paid a concession in 2014 compared to 24% for year-end 2013.

• The average list price of $142,103 has decreased 1.7% from year-end 2013 average list price of $144,594.

• The average number of days a property remained on the market for 2014 was 140 days compared to 138 days for year-end 2013.

• The median sold price of $110,000 for Year-end has increased 11.1% from year-end 2013.

• Sold homes in 2014 received 93.3% of the asking price, a decrease from 94.02% for year-end 2013.

28403

• The average selling price of $212,842 has increased 4.3% from year-end 2013 average selling price of $204,046.

• 28% of sellers paid a concession in 2014 compared to 25% for year-end 2013.

• The average list price of $224,222 has increased 5.2% from year-end 2013 average list price of $213,052.

• The average number of days a property remained on the market for 2014 was 124 days compared to 116 days for year-end 2013.

• The median sold price of $174,500 for Year-end has increased 1.5% from year-end 2013.

• Sold homes in 2014 received 94.9% of the asking price, a decrease from 95.7% for year-end 2013.

28405

• The average selling price of $300,789 has increased 2.5% from year-end 2013 average selling price of $293,443.

• 30% of sellers in 2014 paid a concession compared to 23% for year-end 2013.

• The average list price of $314,652 for 2014 has increased 2.4% from year-end 2013 average list price of $307,332.

• The average number of days a property remained on the market for 2014 was 120 days compared to 141 days for year-end 2013.

• The median sold price of $195,000 for 2014 has increased 5.4% from year-end 2013.

• Sold homes in 2014 received 95.5% of the asking price, an increase from 95.4% for year-end 2013.

28409

• The average selling price of $308,567 has increased 8.6% from year-end 2013 average selling price of $284,192.

• 39% of sellers in 2014 paid a concession compared to 26% for year-end 2013.

• The average list price of $318,635 for 2014 has increased 8.6% over year-end 2013 average list price of $293,510.

• The average number of days a property remained on the market for 2014 was 116 days compared to 102 days for year-end 2013.

• The median sold price of $265,540 for 2014 has increased 12.0% from year-end 2013.

• Sold homes in 2014 received 96.8% of the asking price, it matched 96.8% from year-end 2013.

28411

• The average selling price of $289,741 has increased 4.0% from year-end 2013 average selling price of $278,466.

• 40% of sellers in 2014 paid a concession compared to 33% in year-end 2013.

• The average list price of $303,654 for 2014 has increased 4.9% over year-end 2013 average list price of $289,562.

• The average number of days a property remained on the market for 2014 was 107 days compared to 111 days for year-end 2013.

• The median sold price of $224,950 for 2014 has increased by 4.7% from year-end 2013.

• Sold homes in 2014 received 95.4% of the asking price, a decrease from 96.1% for year-end 2013.

28412

• The average selling price of $196,712 has increased 2.1% over year-end 2013 average selling price of $192,753.

• 41% of sellers in 2014 paid a concession compared to 28% for year-end 2013.

• The average list price of $200,864 for 2014 has increased 2.1% over year-end 2013 average list price of $196,661.

• The average number of days a property remained on the market for 2014 was 95 days compared to 91 days for year-end 2013. The best of all zip codes.

• The median sold price of $174,000 for 2014 has increased 4.6% from year-end 2013.

• Sold homes in 2014 received 97.9% of the asking price, a decrease from 98.0% for year-end 2013.

28451

• The average selling price of $224,523 has increased 9.1% from year-end 2013 average selling price of $205,798.

• 34% of sellers in 2014 paid a concession compared to 26% for year-end 2013.

• The average list price of $226,889 for 2014 has increased 8.6% over year-end 2013 average list price of $208,981.

• The average number of days a property remained on the market for 2014 was 117 days compared to 114 days for year-end 2013.

• The median sold price of $210,000 for 2014 has increased 16.7% from year-end 2013. The best of all zip codes.

• Sold homes in 2014 received 98.9% of the asking price, an increase from 98.4% for year-end 2013. The best of all zip codes.

28480

• The average selling price of $743,370 has increased 2.2% from year-end 2013 average selling price of $727,210.

• 9% of sellers in 2014 paid a concession compared to 8% in year-end 2013. The best of all zip codes.

• The average list price of $810,215 for 2014 has increased 1.4% over year-end 2013 average list price of $799,085.

• The average number of days a property remained on the market for 2014 was 182 days compared to 254 days for year-end 2013.

• The median sold price of $700,000 for 2014 has increased 8.5% from year-end 2013.

• Sold homes in 2014 received 91.7% of the asking price, an increase from 91.0% for year-end 2013.

28428

• The average selling price of $261,366 has increased .3% from year-end 2013 average selling price of $260,637.

• 20% of sellers in 2014 paid a concession compared to 18% for year-end 2013.

• The average list price of $272,238 for 2014 has increased 2.6% over year-end 2013 average list price of $270,732.

• The average number of days a property remained on the market for 2014 was 145 days compared to 180 days for year-end 2013.

• The median sold price of $233,500 for 2014 has decreased 2.7% from year-end 2013.

• Sold homes in 2014 received 96.0% of the asking price, a decrease from 96.2% for year-end 2013.

28449

• The average selling price of $374,272 has increased 1.8% over year-end 2013 average selling price of $367,716.

• 10% of sellers in 2014 paid a concession compared to 8% for year-end 2013.

• The average list price of $390,656 for 2014 has increased 1.9% over year-end 2013 average list price of $383,544.

• The average number of days a property remained on the market for 2014 was 150 days compared to 175 days for year-end 2013.

• The median sold price of $328,250 for 2014 has increased 9.4% from year-end 2013.

• Sold homes in 2014 received 95.8% of the asking price, it matched 95.8% for year-end 2013.

28443

• The average selling price of $259,299 has increased 10.5% over year-end 2013 average selling price of $234,613. The best of all zip codes.

• 41% of sellers in 2014 paid a concession compared to 38% for year-end 2013.

• The average list price of $267,989 for 2014 has increased 11.5% over year-end 2013 average list price of $240,303. The best of all zip codes.

• The average number of days a property remained on the market for 2014 was 132 days compared to 120 days for year-end 2013.

• The median sold price of $240,000 for 2014 has increased 6.7% from year-end 2013.

• Sold homes in 2014 received 96.7% of the asking price, a decrease from 97.6% for year-end 2013.

Ten out of eleven zip codes reported an increase in the average sales price. Eight out of eleven zip codes have the List to Sales price ratio above 95%. Sellers are getting closer to their asking price, which is a good sign that real estate is continuing to improve.

The Great Recession may have knocked real estate values for a loop but it did not change the basic premise that rental real estate is still the best investment value for most Americans. Values are on the rise again. However, this is a bonus and not the basis for investment.

The real story has remained the same through time. The rent coming in pays the mortgage on the property which, over time, allows the owner to have a debt free property that someone else paid for… it doesn’t get better than this! You put up the initial cash down payment-the rent pays the rest. Yes, there will be maintenance, taxes and insurance. That’s all tax deductible and usually covered by the rent, as well. One day, the property is all yours and producing retirement income. And as the real estate market always does, it has rebounded and doubled in value.

Today’s Millenial generation makes up 40% of our population and 90% of them are renters. This demographic is educated, have very good incomes, great credit scores and want nice rental homes. They are unlikely to cause any damage. It is a great time to buy an investment, put it in the hands of a property management company and collect the mortgage payment as rent!